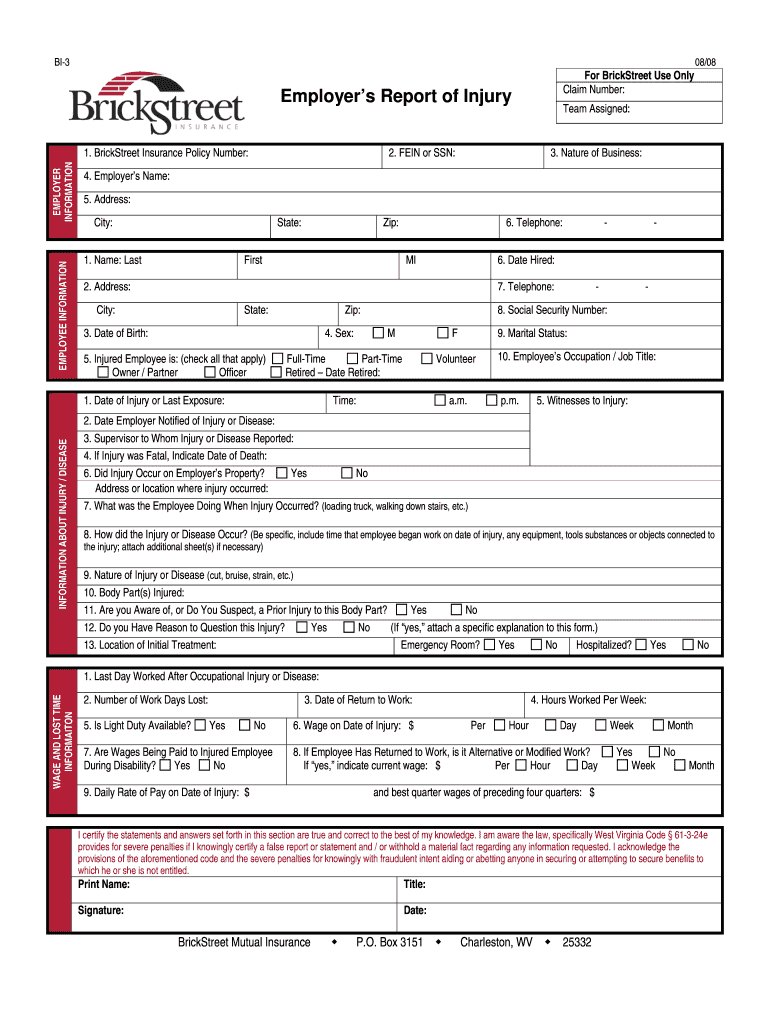

WV BrickStreet BI-3 2008-2024 free printable template

Show details

BI-3 For Backstreet Use Only Claim Number: Employer s Report of Injury EMPLOYEE INFORMATION EMPLOYER INFORMATION 1. Backstreet Insurance Policy Number: 2. VEIN or SSN: 08/08 Team Assigned: 3. Nature

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your 3 report injury form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 3 report injury form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 3 report injury online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit brickstreet report form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

How to fill out 3 report injury form

How to fill out the WV employer report?

01

Gather all the necessary information and documents, such as employee payroll records, tax identification numbers, and annual financial statements.

02

Complete the identification section of the report, including the employer's name, address, contact information, and business identification number.

03

Provide details about each employee, such as their names, social security numbers, wages, and hours worked during the reporting period.

04

Calculate and report the total wages paid to each employee and the corresponding state, federal, and local taxes withheld for each of them.

05

Include information about any additional benefits or compensation provided to employees, such as retirement plans or health insurance.

06

Provide accurate information regarding any new hires, separations, or changes in employment status during the reporting period.

07

Verify all calculations and ensure the report is accurate and error-free before submitting it to the appropriate authority.

Who needs the WV employer report?

01

All employers in West Virginia who have employees working within the state are required by law to submit the WV employer report.

02

This report is necessary for ensuring compliance with state tax regulations and to accurately track and record employment and wage data.

03

Employers must file the report annually to provide an overview of their workforce, wages paid, and taxes withheld during the reporting period.

Video instructions and help with filling out and completing 3 report injury

Instructions and Help about brickstreet first report of injury form wv

Fill form from brickstreet in west virginia called arrive alive defensive driving : Try Risk Free

People Also Ask about 3 report injury

Does West Virginia require workers compensation insurance?

Is workers comp mandatory in WV?

How long does workers comp last in West Virginia?

How long does an employer have to file a workers comp claim in Virginia?

How does workers compensation work in WV?

How long do you have to file a workers comp claim in WV?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How to fill out wv employer report?

To fill out a West Virginia (WV) employer report, follow these steps:

1. Obtain the WV employer report form: Visit the West Virginia State Tax Department website or contact the department directly to obtain the employer report form. The form is usually called something like "Employer's Quarterly Contribution and Wage Report" or "Employer Reconciliation."

2. Gather necessary information: You will need various information related to your employees, wages, and payroll taxes. Make sure to have the following information available before filling out the report:

- Employer identification number (EIN)

- Total wages paid to employees during the reporting period

- Federal employer tax deposits made during the quarter

- Quarterly tax withholding information distributed to each employee

- Number of employees and their details (name, Social Security number, wages paid, etc.)

3. Fill in employer information: Start by filling out the employer information section of the form. This typically includes your business name, address, contact details, and EIN.

4. Provide employee details: Complete the sections related to each employee. Enter their names, Social Security numbers, wages earned during the reporting period, and any other required information. Check that all information is accurate and properly recorded.

5. Calculate taxes and contributions: In the appropriate sections of the form, calculate the various taxes and contributions owing for the reporting period. This may include state unemployment insurance (SUI), state income tax withholding, and any other applicable employer taxes. Consult the instructions or guidelines provided with the form to ensure accurate calculations.

6. Complete the reconciliation section: If required, complete the reconciliation section of the form. This section reconciles the taxes and contributions you withheld from employees' wages and the deposits you made.

7. Attach any additional required documentation: Check if any supporting documents or schedules are required to be attached with the employer report. Generally, you need to include copies of quarterly income tax withholding statements given to employees, federal tax deposit slips, and any other relevant documentation.

8. Review and double-check: Once you have completed the form, thoroughly review all the details to ensure accuracy and completeness. Double-check calculations, employee information, and any supporting documentation.

9. Sign and submit: Sign the form when you are satisfied with its accuracy. Depending on the WV State Tax Department's requirements, you may need to mail the form, submit it online through a designated portal, or use an electronic filing method. Follow the instructions provided with the form or contact the department for any clarification.

If you are unsure about any specific details or calculations while filling out the WV employer report, consult a tax professional or contact the West Virginia State Tax Department for assistance.

What is wv employer report?

The term "wv employer report" is not a widely recognized or commonly used term. Therefore, it is difficult to provide a specific answer without more context. It is possible that it could refer to a report or document related to an employer in the state of West Virginia (abbreviated as WV). The content and purpose of such a report would vary depending on the specific context and requirements.

Who is required to file wv employer report?

Employers in the state of West Virginia are required to file an employer report.

What is the purpose of wv employer report?

The purpose of the WV employer report, also known as the Employer's Quarterly Contribution and Wage Report, is to provide information on wages paid and unemployment insurance contributions made by employers in West Virginia. This report is submitted on a quarterly basis to the West Virginia Division of Employment Security. It helps the government track, verify, and administer unemployment insurance benefits and calculate employers' contribution rates for the following year. The report ensures compliance with state laws regarding unemployment insurance and assists in determining eligibility for unemployment benefits for workers who have lost their jobs.

What information must be reported on wv employer report?

The information that must be reported on the Employer Report in West Virginia includes:

1. Employer Information: This includes the employer's legal name, address, and federal employer identification number (FEIN).

2. Employee Information: This includes the employee's full name, social security number, and wages earned during the reporting period.

3. Withholding Information: This includes the total amount of state income tax withheld from employees' wages during the reporting period.

4. Unemployment Compensation Information: This includes the total amount of unemployment compensation paid to employees during the reporting period.

5. Other Deductions Information: This includes any other deductions made from employees' wages, such as for health insurance, retirement contributions, or wage garnishments.

6. Employment Status Information: This includes information about the employees' employment status, such as whether they are full-time, part-time, seasonal, or terminated.

7. Previous Reporting Period Information: If this is a subsequent report, the employer may need to provide information about the previous reporting period, such as any adjustments or corrections made.

It is important for employers to accurately report all required information on the Employer Report to ensure compliance with West Virginia tax and labor regulations.

What is the penalty for the late filing of wv employer report?

The penalty for late filing of West Virginia employer reports varies depending on the specific type of report and the duration of the delay. Generally, the penalty is based on a certain percentage of the total amount of contributions due for the period, with a minimum and maximum penalty amount set by state law.

For example, if the filing is less than 30 days late, the penalty can be 2% of the amount of contributions due, with a minimum penalty of $50 and a maximum penalty of $5,000. If the filing is 30 days or more late, the penalty can increase to 5% of the amount of contributions due, with a minimum penalty of $100 and a maximum penalty of $10,000.

It's important to note that these penalties are subject to change and specific details can be found in the West Virginia State Code or by contacting the West Virginia Division of Employment Security.

How can I modify 3 report injury without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including brickstreet report form, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I send s brickstreet number to be eSigned by others?

When your s brickstreet i is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Where do I find brickstreet injury?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific brickstreet wv first report of injury form and other forms. Find the template you need and change it using powerful tools.

Fill out your 3 report injury form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

S Brickstreet Number is not the form you're looking for?Search for another form here.

Keywords relevant to encova brickstreet accident report form

Related to s disease brickstreet

If you believe that this page should be taken down, please follow our DMCA take down process

here

.