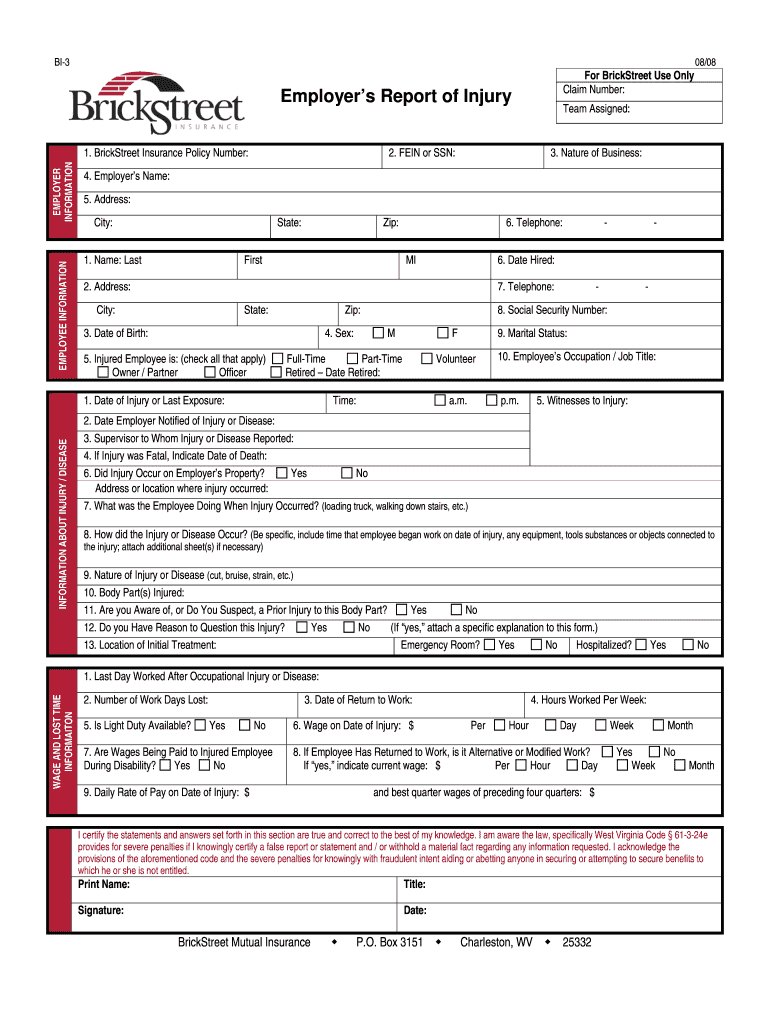

WV BrickStreet BI-3 2008-2026 free printable template

Show details

This document is used by employers to report injuries or diseases sustained by employees to BrickStreet Insurance, complying with West Virginia law.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WV BrickStreet BI-3

Edit your WV BrickStreet BI-3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WV BrickStreet BI-3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing WV BrickStreet BI-3 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit WV BrickStreet BI-3. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out WV BrickStreet BI-3

How to fill out WV BrickStreet BI-3

01

Obtain the WV BrickStreet BI-3 form from the BrickStreet website or your employer.

02

Fill in your personal information in the designated fields, including your name, address, and contact information.

03

Indicate your employer's name and address in the appropriate section.

04

Specify the dates of the injury or illness in the specified fields.

05

Provide a detailed description of the injury or occupational disease, including how it occurred.

06

List any medical treatments you have received related to your injury or illness.

07

Sign and date the form at the bottom.

Who needs WV BrickStreet BI-3?

01

Employees who have sustained a work-related injury or illness.

02

Employers who need to file a claim on behalf of an injured employee.

03

Workers' compensation insurance providers handling claims in West Virginia.

Fill

form

: Try Risk Free

People Also Ask about

Does West Virginia require workers compensation insurance?

Workers' Compensation WV Nearly all employers in West Virginia must carry workers' compensation insurance. The WV workers' compensation system provides benefits if your employees get an injury or illness from their job. Workers' comp also helps protect your business from the liability of work-related incidents.

Is workers comp mandatory in WV?

All West Virginia employers are statutorily required to maintain workers' compensation insurance coverage. Visit the West Virginia Offices of the Insurance Commissioner Employer Coverage Unit online to file workers' compensation.

How long does workers comp last in West Virginia?

Maximum period of payments is 104 weeks. Note: West Virginia Workers Comp Division established guides for disability periods who are on TTD. Check with the state website below for details about these guides.

How long does an employer have to file a workers comp claim in Virginia?

Your employer should file a report of the accident or disease with the Commission within ten days Failure to report your injury or illness to your employer within thirty (30) days could result in your claim being denied. See Va.

How does workers compensation work in WV?

To make up for missed wages, an employee with a work-related injury or illness is eligible to receive up to two-thirds of their pre-injury average weekly earnings. Temporary total disability benefits begin after they can't work for more than three consecutive calendar days.

How long do you have to file a workers comp claim in WV?

Claims Must Be Filed Within Six Months West Virginia requires injured workers to file an application for benefits within six months of the date of injury. Do not allow yourself or your loved one to miss out on valuable financial help to replace lost wages, cover medical expenses, and more.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify WV BrickStreet BI-3 without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including WV BrickStreet BI-3, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I send WV BrickStreet BI-3 to be eSigned by others?

When your WV BrickStreet BI-3 is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Where do I find WV BrickStreet BI-3?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific WV BrickStreet BI-3 and other forms. Find the template you need and change it using powerful tools.

What is WV BrickStreet BI-3?

WV BrickStreet BI-3 is a form used to report and calculate the business information needed for workers' compensation insurance in West Virginia.

Who is required to file WV BrickStreet BI-3?

Employers in West Virginia who are required to report their workers' compensation insurance data must file the WV BrickStreet BI-3.

How to fill out WV BrickStreet BI-3?

To fill out the WV BrickStreet BI-3, employers must provide specific details about their business, employee classifications, payroll amounts, and any other relevant data as instructed on the form.

What is the purpose of WV BrickStreet BI-3?

The purpose of the WV BrickStreet BI-3 is to ensure that businesses accurately report their payroll and employee classifications for determining workers' compensation premiums.

What information must be reported on WV BrickStreet BI-3?

The information that must be reported on WV BrickStreet BI-3 includes details about the company's employees, payroll sizes, job classifications, and any other relevant business information necessary for compliance.

Fill out your WV BrickStreet BI-3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WV BrickStreet BI-3 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.